Key Property Tax Dates

- February 13: Property Assessment Notices Mailed

- April 22: Complaint Due Date

- June 2: Annual Tax Notices Mailed

- June 30, 2025: Payment Due

The Government of Alberta has guidelines for property assessment to ensure that all property owners pay their fair share of property taxes. The Town of Canmore contracts Legassy Municipal Services to provide all property assessment services in Canmore.

By legislation, the Town of Canmore collects only enough taxes to support its programs and services — it cannot collect more, and it cannot collect less.

The Town of Canmore distributes property tax notices in late May every year and asks property owners to pay their taxes in full by the last business day in June to avoid late-payment penalties. Non-receipt of your property tax bill does not exempt you from penalty due to late payment.

As per the Tax Penalty Bylaw, a 5% penalty is calculated on the first day of each month, January, May, and September against all tax arrears until paid in full. Penalties to current taxes not paid by the due date will be calculated on each of the following days: 5% on July 15; 5% on the first business day of September; 5% on the first business day of October.

Change of Banking for your Pre-authorized Payment Plan

If you are participating in the Tax Installment Payment Plan (TIPP) and/or the Pre-authorized Utility Payment Plan (PUPP) and would like to change your banking information you need to inform us, in writing, of this change and provide a new void cheque or Pre-Authorized Debit (PAD) form from your bank. Download the change of banking form.

Account Holder Changes

It is the owners' responsibility to keep their contact information with the Town of Canmore current. You can find the Change of Mailing address form here.

Cancellations to your Pre-authorized Payment Plans

You can discontinue your pre-authorized payment plan(s) for your property tax and/or utility accounts by submitting a completed Tax and Utilities Termination Form (TIPP/PUPP Cancellation). If you are moving, please be sure to review the additional instructions on the 'Moving, Buying, or Selling a Property' page.

Recently Married or Divorced?

If the status of your name has changed, you must first register the change with the Alberta Land Titles office. The name(s) on your Town of Canmore tax and utility account will then be changed in due process.

Add an Authorized Agent to Manage the Account

As a property owner you may add a designated agent to your property tax and/or utility accounts. This can be an individual who is not a property manager, such as a member of your family. Alternatively, you can designate a property management company as an authorized agent to manage your account(s). Download and complete the Authorized Agent - Individual or the Authorized Agent - Property Manager form and return it to the email as listed at the top of the form.

Law Firms Requesting a Tax Certificate - Tax Certificates can be immediately obtained via our Online Services site. The fee for online Tax Certificates can be found under Finance Fees in the Fee Schedule and is payable by credit card at the time of ordering or can be invoiced. Statements will be issued monthly. There is a higher fee if the office produces the tax information instead of using our Online Services site. To request a username for your firm, please email online@canmore.ca with your law firm details. Please include "Request for Tax Certificate" in the subject line of your email.

Log into your Virtual Town Hall

Alternatively, contact the Tax Department at taxes@canmore.ca

Your municipal taxes pay for services such as paving roads, providing transit, planting trees, maintaining parks, clearing snow, staying safe, improving neighbourhoods, sweeping streets, building recreation facilities, and providing affordable programs and social services that make our community a great place to live. Every year, Council determines the amount of money needed to fund operation of the Town of Canmore. A municipal budget funded through property taxes benefits your community in a variety of ways and is vital to the ongoing health of any community. The tangible benefits provided by the Town of Canmore can be categorized into the seven S’s: We provide for the safety of residents and visitors through police and fire response along with education and enforcement of bylaws. In addition, we protect the community from flooding and fire through steep creek hazard mitigation and FireSmart practices. Prevention, emergency preparedness and emergency social supports are key to community safety.

We work towards sustainability of our community by diverting residential and commercial food waste and recycling. We research and monitor opportunities for solar installation on municipal facility rooftops as a way to conserve and procure energy. As we implement, monitor, and report actions related to energy and climate protection, we also conserve resource including prioritizing wildlife co-existence through attractant reduction programs. We provide both indoor and outdoor spaces including 63 buildings located at 23 different sites that cover over 360,000 ft2, as well as maintaining and operating all municipal trails, parks, sports fields, green space, playgrounds, outdoor ice surfaces, dog parks, vault toilets, and the cemetery. Indoor recreation facilities at Canmore Recreation Centre and Elevation Place including ice rinks and swimming pools. Streets and roads are maintained in the winter and summer and rehabilitated through capital funding and are part of an overall transportation network including bridges, sidewalks, paved pathways, and parking lots. This also includes pavement markings, signage, street lighting, and traffic signal light maintenance. Funding fare-free local transit. The services we provide are extensive and diverse; some examples include pet licensing, returning found pets to owners, recreation programming including indoor climbing opportunities, aquatics programs, fitness classes, lost & found services, promoting and supporting local business including retention, expansion, innovation, and diversification, delivering cultural and artistic programming, including the public art program, special event delivery and support for community events including film permits, building and development permits, building inspections, Family and Community Support Services (FCSS), Family Resource Network (FRN), counseling, child development, social and neighbourhood connections, affordability support services including providing emergency food, non-profit organization support, and volunteer recruitment and management.

Sanitation services are wholly supported by user rates and are essential to a good quality of life. As part of the utility rates, we provide daily waste container servicing (pedestrian and neighbourhood bins), a depot for specialty items such as used oil and leaf collection, large item cleanup program, water treatment and distribution, wastewater treatment and collection, storm water management, utility meter reading and billing, and utility capital upgrades to meet the changing needs of the community. All of these categories require support including insurance, debt repayments, long term financial planning including transfers to reserve funds, paying bills, financial accounting and reporting. Property assessment and taxation is required. As well, support includes public engagement, providing information to the public through advertising and marketing. This requires network servers, telecom systems, and infrastructure including systems security. Employees are required to do the work and must be recruited, trained, and compensated. Procedural and administrative support for council, including municipal elections and plebiscites, records management, bylaw and policy development, municipal census, FOIP is provided.

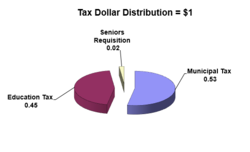

For a copy of the current year's budget visit Budget & Financial Information. The distribution of your yearly property taxes is as follows:

Provincial Education Tax

All property owners whether they have children or not, are required to pay education taxes. The Town of Canmore collects education taxes on behalf of the Alberta School Foundation Fund (ASFF) but has no jurisdiction over setting the tax rate for school taxes. For more information on Provincial Education Taxes call 310-0000 toll free and ask for 780-422-7125. The ‘declaration of faith’ school support document is an affiliation of faith. Your declaration will appear on your tax account as well as your Notice of Assessment and Annual Tax Notice. However, all school funds are distributed from the pooled amounts collected by the Province and are based on school enrollment. If a declaration of faith is not received, your property will default to 'Undeclared.'

Bow Valley Regional Housing (BVRH)

The BVRH requisition is for supportive living accommodation for seniors in the Bow Valley and is supported by the Town of Canmore, ID#9 (Banff National Park), Town of Banff, Kananaskis Improvement District, and the M.D. of Bighorn. This requisition is paid by all property owners including seniors. More information about BVRH can be found on their website.

Vital Homes

The purpose of collecting the Vital Homes contribution is to accumulate capital funds for the purchase of land and construction of Vital Homes units. The construction and supply of these units is intended to address the affordable housing demand of Canmore residents unable to purchase or rent accommodation on the open market.

Please provide your 5-digit tax roll number and/or your property address when contacting the Tax Department. Your tax roll number is in the upper right hand area of your Tax Notice and your Annual Assessment Notice.

By email: taxes@canmore.ca

Please include the 5-digit tax roll number and property address in the subject line.

By phone: 403.678.1506

By mail: Town of Canmore Property Tax Department 902 7 Avenue Canmore, AB T1W 3K1

Each year, the Town of Canmore reviews how much money it needs to provide high quality services to the residents of Canmore. This budget process allows Council to identify where the money is needed most, and helps determine the budget to meet those needs. As part of this process, Council considers where the money to cover municipal programs and services comes from. Property taxes collected from residential and non-residential properties (including commercial properties) is one of the main revenue sources available for any municipality in Canada to pay for municipal services.