What You Need to Know

- Residential property owners in Canmore will need to declare whether it was used as a primary residence on a full-time basis during the past calendar year.

- If you don’t declare, your property will automatically be taxed at the higher residential tax rate and you will lose the ability to file a complaint about your property tax assessment for the 2026 taxation year.

- We will only accept one declaration per tax roll.

- Declarations are due by Dec. 31, annually.

What you Will Need to Submit Your Declaration

This fall, property owners will receive a letter in the mail with your tax roll number and access code to complete the declaration online.

The Livability Tax Program is part of our path forward to support a Canmore where average residents can buy a home, raise a family, and age in place with dignity. It will help fund new affordable housing options, while incentivizing our neighbours to join us full-time.

Canmore is experiencing a housing crisis. With 25% of homes not occupied by a full-time resident and a 0.9% vacancy rate, many of people who serve our food, run our businesses, and teach our children can’t afford to live here.

Vacant homes have a huge effect on housing affordability. While we have approved numerous new developments, supply is not keeping up with demand.

There’s no quick fix, but the Livability Tax Program is one of our best tools we have to make a difference on our housing crisis. It is part of a larger plan to take action on housing.

Here is how it works:

- The program creates subclasses of residential property types, with a higher tax rate for homes that don’t house a full-time resident.

- Homes that aren’t occupied by a permanent resident for at least 183 days per year, including at least 60 days in a row will be taxed at an additional approximately 0.4% of the property value.

- We know this tax is a change. We purposely chose lower rates than others in Canada who have introduced these different types of By contrast, British Columbia’s similar speculation tax on vacant homes is up to 3%.

- We will reinvest revenue generated from the Livability Tax Program into non-market housing and affordability initiatives.

Need Help?

If you have questions or need assistance, email housingaction@canmore.ca or call 403.678.1594.

Frequently Asked Questions

- A primary residence is a property where the owner or renter conducts their daily life, their government issued identification shows this address, as well as their CRA documents and any other mail they may receive, and

- the owner or renter must live in a dwelling unit on the property for at least 183 cumulative days in a calendar year, and

- 60 of the days must be continuous. This does not mean the owner or renter can't go away for the weekend or on vacation. It means the property is your primary residence you return to. This provision is meant to prevent properties being rented out short-term from qualifying, and

- the property cannot be in the Tourist Home subclass.

The requirement is that the Canmore property be a person's primary residence for at least 183 days of which 60 are continuous, not that a person must be physically in the property for those number of days. Leaving for vacation, to visit family, or traveling abroad does not change a person's primary residence. It changes where they sleep on any given night, but the requirements for this program aren't about where you sleep.

Not sure what your primary residence is? Some questions to ask include: what address is on your driver's license? Where does your mail go to? Where does any correspondence from Canada Revenue Agency get addressed to? Where do you normally return to after you've been away? Do you own or rent other property somewhere else? If so, how often are you there compared to how often are you in Canmore?

This list above is not exhaustive nor prescriptive. The important aspect of these qualifications is that the number of days applies to the number of days as a primary residence and not the number of days a person is physically in their property.

An owner of a qualifying residential property, or their authorized agent, will be required to declare annually if their property is eligible for the primary residential subclass.

Declarations will be required by December 31st of each year for the purposes of assessing taxes owing in the following calendar year. For example, a declaration attesting to the property’s qualification as a primary residence in 2025 will be due by December 31, 2025, for the purpose of assessing the 2026 property taxes. Print and/or retain a copy of your declaration for your records.

This declaration will be conducted online and only one owner, or their authorized agent, can declare. You do not need to upload any supporting documents, but you may be asked for them later.

Access Codes are included on the Primary Residence Declaration letter mailed to qualifying residential property owners annually in late October. During the annual declaration period, if you have lost or misplaced your Access Code, a link to an online form will be posted here where you can request a new one.

We will post the link to request a re-issued 2025 Access Code after Nov. 10.

Effective 4:30 p.m. on Dec. 30, the Housing Action Team will no longer be able to re-issue access codes. Please note that the declaration period closes at 11:59 p.m. on Dec. 31, annually.

An authorized agent is defined as a person or company authorized to act on behalf of a residential property owner in the Town of Canmore. This can be an individual who is not a property manager, such as a member of your family. Alternatively, you can designate a property management company as an authorized agent to manage your account(s). Download and complete the Authorized Agent - Individual or the Authorized Agent - Property Manager form and return taxes@canmore.ca as listed at the top of the form.

Declarations may be audited for up to three years. False or misleading declarations may result in fines of up to $10,000, plus payment of the higher taxes and penalties that would have applied.

Declarations chosen for audit will require submission of supporting documentation.

In the bylaw, under the definition of "primary residence", it lists examples of documents that would support a declaration of primary residence; this is not an exhaustive list:

- The physical address shown on the person's driver's license or motor vehicle operator's license issued by or on behalf of the Government of Alberta or an identification card issued by or on behalf of the Government of Alberta,

- The physical address to which the person's income tax correspondence is addressed and delivered,

- the physical address to which most of the person's mail is addressed and delivered.

Other documents may be accepted. The key is that you can show the physical address of where you are considered to be primarily located.

If you made your declaration online and accurately provided your email address, you will receive an email confirming your declaration. Be sure to keep this confirmation for your records. It is also your responsibility to review your Assessment Notice, which will be mailed in late February, to confirm the subclass assigned to your property. If you believe a change is necessary, please follow the subsequent steps outlined in the notice.

Apartment buildings (Assessment Code 12M) defined as a single building with three or more units under one tax roll will be automatically placed in the primary residential subclass, no declaration will be required. If you are unsure if your property qualifies as an apartment, contact housingaction@canmore.ca to confirm.

Properties that have been approved and assessed as employee housing as defined in the bylaw (Assessment Code 12E), and individually titled residential parking stalls and storage units (Assessment Code 15R) will also be automatically placed in the primary residential subclass.

Your property may qualify under one of the following exceptions, however you will still need to submit a declaration to claim an exception.

The bylaw includes properties in the primary residential subclass if the following occurred:

- the property was sold to an arm's length party in the previous taxation year, is registered or in the process of being registered with Land Titles and is immediately occupied (by the purchaser or a tenant) as a primary residence.

- the property was newly constructed, occupation and normal use of the property as a primary residence was not possible,

- a dwelling unit on the property was undergoing permitted repairs or renovations that prevented occupancy and the property was used as a primary residence immediately before,

- the owner is deceased in the last two years and the property was used as a primary residence immediately before,

- the owner is hospitalized, or placed in a long term or supportive care facility and the property was used as a primary residence immediately before,

- written order was in force that prohibited occupancy and the property was used as a primary residence immediately before,

- a dwelling unit on the property was impacted by a catastrophic event that prevented occupancy and the property was used as a primary residence immediately before.

If your residential property is being rented to someone who uses the property as their primary residence, the property can qualify as Primary Residential.

Using the online declaration form, complete the questions as follows:

- Property Owner: Are you an owner of the property? – YES

- Occupying a Dwelling Unit: Are you or the person you represent occupying a dwelling on this property as your/their primary residence in the declaration year? – NO

- Rented: Is a dwelling unit on the property rented to someone whose primary residence it is in the declaration year? - YES

On November 19, 2024 the Division of Class 1 Property Bylaw 2024-33 was amended to address residential properties under construction as an exception:

5.c.1) the property was newly constructed or under construction in the Previous Taxation Year, the property is owned by the builder or developer who constructed it, and the builder is either marketing the property for sale as of December 31 of the Previous Taxation Year or will market the property for sale once construction is complete;

Online declarations for these properties are still required by the December 31 declaration due date.

Using the online declaration form, complete the questions as follows:

- Property Owner: Are you an owner of the property? – YES

- Occupying a Dwelling Unit: [Enter the number of dwelling units as defined.] Are you or the person you represent occupying a dwelling on this property as your/their primary residence in the declaration year? – NO

- Rented: Is a dwelling unit on the property rented to someone whose primary residence it is in the declaration year? – NO

- Property Sale: Was 100% legal ownership of the property transferred in the declaration year… and the purchaser or a tenant immediately occupied a dwelling unit with the intention that it be their primary residence? – NO

- Newly Constructed: Was the property newly constructed in the declaration year, occupation and normal use of the property as a primary residence was not possible…? – YES

- Tax Declaration Name and Email: Example: Jane Smith of Canmore Construction and Development.

- Declaration: read and check the box if you agree.

- Click ‘Next Step’

On December 10, 2024 Council approved the Livability Tax Program budget at $12 million for 2025 and 2026, and $10.5 million for 2027 and 2028.

On February 11, 2025 Council amended the budget for the Livability Tax Program in 2025 and 2026 to $10.3 million. This change was made following the completion of the declaration period and having the assessment values for the 2025 tax year.

The $10.3 million represents a tax of approximately 0.4% of assessed value. The Livability Tax will be displayed under the municipal portion of your tax bill.

Mill rates are set by Council in May and are based on the approved budget and 2025 property assessments.

For example, based on 2024 Mill Rates:

The median assessed residential condo ($761,000) would pay the following rates as displayed under the municipal portion of your tax bill:

- Residential taxes (including Vital Homes Residential Tax) at approximately 0.2%: $1,574

- Livability Tax for Non-Primary Residential at 0.4%: $3,044

- Total Municipal Tax: $4,618

The median residential property ($1,043,000) would pay the following rates as displayed under the municipal portion of your tax bill:

- Residential taxes (including Vital Homes Residential Tax) at approximately 0.2%: $2,156

- Livability Tax for Non-Primary Residential at 0.4%: $4,172

- Total Municipal Tax: $6,328

The revenue will be used to support affordability in Canmore through such things as developing non-market homes and the Town supported infrastructure to support them.

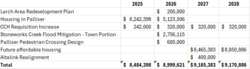

The chart on the left (click to expand) shows the council approved budget for the Livability Tax Program. The budget will also cover the administration and enforcement of the program, which is not reflected in the chart.

On June 6, 2023, council approved a Housing Action Plan, to encourage long-term occupancy of vacant homes, limiting the growth of tourist homes, encourage an increase in rental supply, and create a sustainable source of funding to support affordable housing.

For more information about our work to keep Canmore within reach, visit canmore.ca/housingaction